Are you aware of what financial factoring is?

Franco Brutti

One of the aspects that usually stops many people from starting their own business is the financial issue, and the first few months are the toughest of all.

It’s during this initial period that more capital and liquidity are usually required, and in many cases, these are the most scarce monetary funds.

This type of problem also affects already consolidated companies when there are other economic risk factors present, such as inflation.

If you’re going through any of these cases and you are not yet aware of the way in which financial factoring can help you, it’s about time you learn about it.

It’s one of the financial alternatives that allows any type of company to have the necessary liquidity to keep its business afloat.

So... What is financial factoring?

Financial factoring is a tool that allows companies to obtain immediate liquidity from their uncollected invoices.

In essence, financial factoring involves the sale of invoices to a factoring company, which is responsible for collecting the amount of the invoice from the company's customer and, in exchange, advances a portion of the invoice amount to the company that issued the invoice.

In other words, it is a process in which a third-party company is used to provide financing for those customer invoices that are not paid immediately.

In these cases, it is very true that you may find yourself in a situation in which your business lacks liquidity since you will have to wait for your customers to pay before receiving money again.

That’s why financial factoring has become a very popular financing alternative for small and medium-sized companies.

It allows them to improve their cash flow and obtain working capital without having to resort to traditional bank loans or having to change their collection methodologies.

How does financial factoring work?

Now, we know that at first, the definition may be somewhat complicated to understand, especially if it’s the first time you read about this topic.

Therefore, in order for you to better understand how this alternative works, we will explain the steps involved:

Your company issues an invoice for a good or service it has provided to a customer.

You sell that invoice to a factoring company in exchange for a cash advance, which is usually around 80% of the invoice value.

The factoring company then becomes responsible for collecting the invoice from the company's customers.

When the client pays the invoice, the factoring company retains a percentage as a commission for its services and transfers the rest of the money to your company.

Your company receives the remaining money, which is usually around 20% of the invoice value after deducting the factoring company's commission.

Thanks to this mode of operation, it has become a very effective solution for companies that need immediate working capital and do not want to wait for their customers to pay their invoices.

In addition, financial factoring can reduce the company's administrative burden by outsourcing everything to a third party that has to do with collection management and invoicing.

What are the types of financial factoring?

Of course, it should not be overlooked that the financial needs of one company may be very different from those of another.

That’s why there’s not just one type of financial factoring, but several, since each one seeks to satisfy different types of business needs.

In order to give you a better idea of how each of them works, we will tell you a little about them below:

1. Non-recourse financial factoring.

When working with invoices that customers can pay later, there is always the risk of non-payment.

Well, when we talk about non-recourse factoring, we are dealing with an alternative in which the factoring company assumes all the risk of non-payment by the customer of the company that issued the invoice.

In other words, if the customer does not pay the invoice for the product purchased from your business, the factoring company cannot reclaim the money from your company.

Of course, this type of financial factoring is usually one of the most expensive, since the risk that must be assumed, the commissions for the service are higher.

2. Financial factoring with recourse

Factoring with recourse is the opposite of the type explained above.

In this case, the company that has issued the invoice assumes the risk of non-payment by your client.

If your client does not pay the invoice, the factoring company will have every right to claim the money from you and you will be obliged to give it to them, even if the client has not paid you.

As you can imagine, this type of financial factoring is usually more accessible than non-recourse factoring and this is due to the lower risk assumed by the factoring company in question.

Therefore, if you want to resort to this type of solution, you must be certain that your customers are reliable and will always pay.

3. International Financial Factoring

So far, all this sounds wonderful to you, but wait, because there’s still more.

It turns out that there is also international factoring, which can be used by companies that issue invoices to customers abroad.

In these cases, the factoring company will handle payments and transactions in different currencies and may even offer additional services such as exchange rate insurance.

4. Export financial factoring

Last but not least, there is export factoring.

This is when the main company exports goods or services to customers abroad.

In this case, the factoring company can offer additional services such as financing transportation and handling the necessary export documents.

So, if international sales are one of your company's objectives, you should know that thanks to the alliance with a financial factoring company you will be able to achieve it.

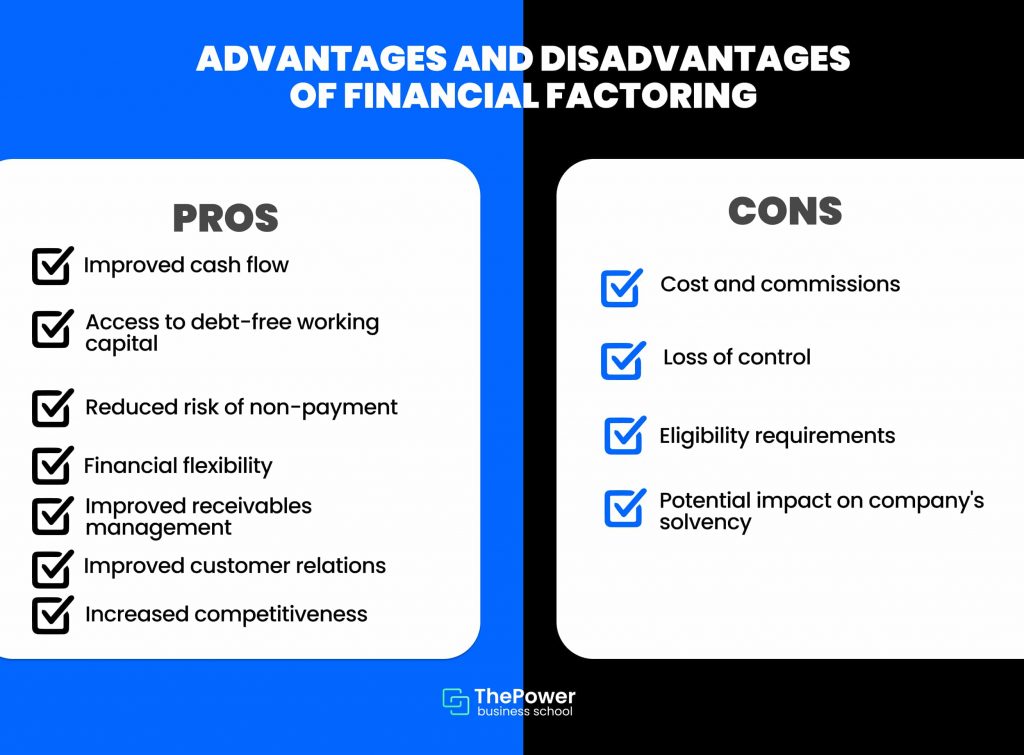

Advantages and disadvantages of financial factoring

However, it’s important to keep in mind that, just like any other type of financial solution, factoring can be both beneficial and risky.

That’s why, before you decide to hire the services of such a company, you should be aware of its positive and negative aspects:

Pros

Improved cash flow: because companies obtain immediate working capital, their cash flow will improve and they will be able to meet their expenses and financial obligations without having to wait so long.

Access to working capital without debt: it’s an option that allows businesses to obtain working capital without having to resort to traditional bank loans, thus avoiding the accumulation of debt.

Reduced risk of non-payment: it also helps to reduce the risk of non-payment of invoices, since the factoring company takes care of collection management and invoicing, thus relieving the main company of these tasks.

Financial flexibility: this is a flexible solution that adapts to the needs and circumstances of each company, as it can be used on an ad hoc basis only at certain times or on a regular basis.

Improved collection management: since the factoring company is in charge of collection management and invoicing, the administrative burden on the main company is reduced.

Improved customer relationships: By offering your customers longer and more flexible payment terms, you can improve your relationship with them, which will also positively influence their purchasing decisions.

Increased competitiveness: Financial factoring allows companies to access working capital more quickly, which can improve their ability to compete in the marketplace against other businesses and take advantage of growth opportunities.

Cons

Cost and commissions: of course, this option can be more expensive than other forms of financing, since the factoring company charges a commission for its services and may set higher interest rates than some banks.

Loss of control: by using financial factoring, the company relinquishes control of collection management and invoicing to the factoring company, which may affect the company's image with its customers.

Eligibility requirements: companies must meet certain requirements to be eligible for this option, such as having verifiable commercial invoices and solvent clients; requirements that may limit access to financial factoring for some companies.

Potential impact on the company's creditworthiness: Financial factoring can have a negative impact on the company's creditworthiness if it’s used imprudently or excessively. If the company relies too heavily on financial factoring, it may end up selling too many invoices and become overly dependent on this type of financing.

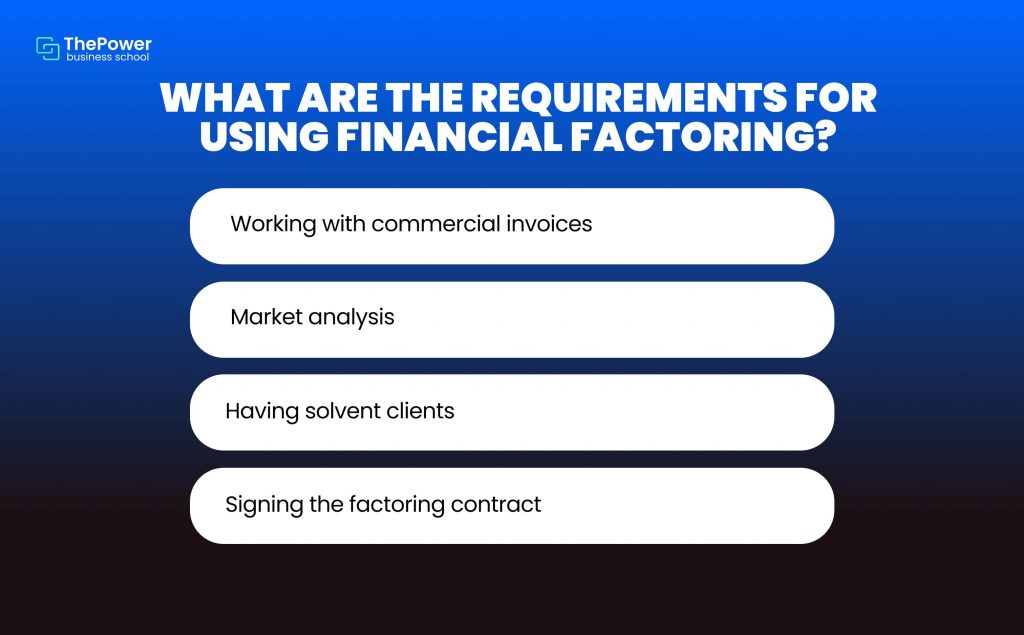

What are the requirements to use financial factoring?

As we mentioned in one of the disadvantages of this topic, in order to use financial factoring you must comply with some mandatory requirements.

That’s why it’s possible that many businesses don’t have what’s necessary to access this financing service.

In addition, it‘s quite likely that the requirements will change depending on the company and the specific type of factoring service you are going to hire.

So, in order for you to be aware of whether your company complies with what is requested, below we will talk about the most common requirements:

1. Working with commercial invoices

One of the most requested requirements is that the company must issue commercial invoices to its customers in order to be able to use this financing tool.

Note that the invoices must be verifiable and must not be subject to disputes or controversies.

If you don’t work with this type of invoice, it’s very unlikely that any factoring company will consider you suitable for the service.

2. Having the necessary invoicing volume

Similarly, companies are usually required to have a minimum invoicing volume to be able to access this type of financing.

However, the percentage of volume required may vary depending on the factoring company and the type of factoring you are looking to hire.

3. Having solvent clients

As you can imagine, another essential requirement is that you have solvent and reliable customers who pay their invoices on time and on budget.

Keep in mind that factoring companies usually perform a risk assessment of the main company's clients to ensure that this point is met.

4. Signing the factoring contract

Finally, if you wish to have this service, you are required to sign a factoring contract with the company specifying the terms and conditions of the agreement, including commissions and payment terms.

This is not a service that is free of formalities and you must agree to them.

In conclusion...

Financial factoring is a very useful tool for companies that need immediate working capital and do not want to resort to traditional bank loans full of requirements and a long waiting time.

Thanks to the various benefits it offers, companies that resort to this method will be able to stay afloat without any problems.

Just remember to evaluate the requirements and fees carefully to determine if it’s really something that’s right for you.

Also, if you have any questions about financial factoring, feel free to leave them in the comments so that we can answer them.

Looking for something specific?