Churn rate impact on SAAS

Franco Brutti

Let's talk about "saas churn rate": Subscription businesses have boomed in the last decades. It is no wonder, the reality is that this type of business model has many advantages.

When we talk about subscription businesses, we refer to those businesses that provide a service or product in exchange for a monthly fee. Perhaps the most emblematic example is Netflix. But it is not necessary to go that far, a gym or even the cell phone service that we pay for every month are managed in this way.

However, as in any business, not everything is nice and easy. That is why in today's article we are going to talk about the advantages and disadvantages of this type of business and we are going to show you what metrics you should take into account to understand if the marketing strategies you are carrying out are being effective or if you need to turn things around.

Are you ready? Let's go for it!

What are the advantages and disadvantages of subscription businesses?

The advantages are many and in plain sight:

Recurring and stable revenues.

Stock forecasting.

Loyalty and long-term relationships with our customers.

Liquidity.

Building a sense of community around our brand.

Now, what about the disadvantages?

One of the main disadvantages of this business model is that in order to be cost-effective it needs a large number of subscribers since, in general, the monthly fee paid by customers is low. Many times, gathering the necessary number of subscribers and maintaining them over time is neither easy nor fast.

In this sense, calculating the price of our monthly subscription is not always easy. Because it must be attractive enough to add new subscribers, but it must also be able to lead us to profitability in a short period of time.

One of the most important challenges in these business models is our ability to keep a customer with us for as long as possible. This is usually demanding because we need to invest time and money to maintain and increase the value of our product or service.

Month by month we must, at a minimum, capture the same number of subscribers as those who abandon our product or service and this means a constant investment in acquisition marketing.

To analyze in detail everything we've been saying, we are going to analyze one of the most important metrics that we must take into account in a subscription business: the Churn Rate. Have you heard of it? Don't be scared, it's quite simple to understand. We'll tell you all about it below.

What is Churn Rate and how to calculate it

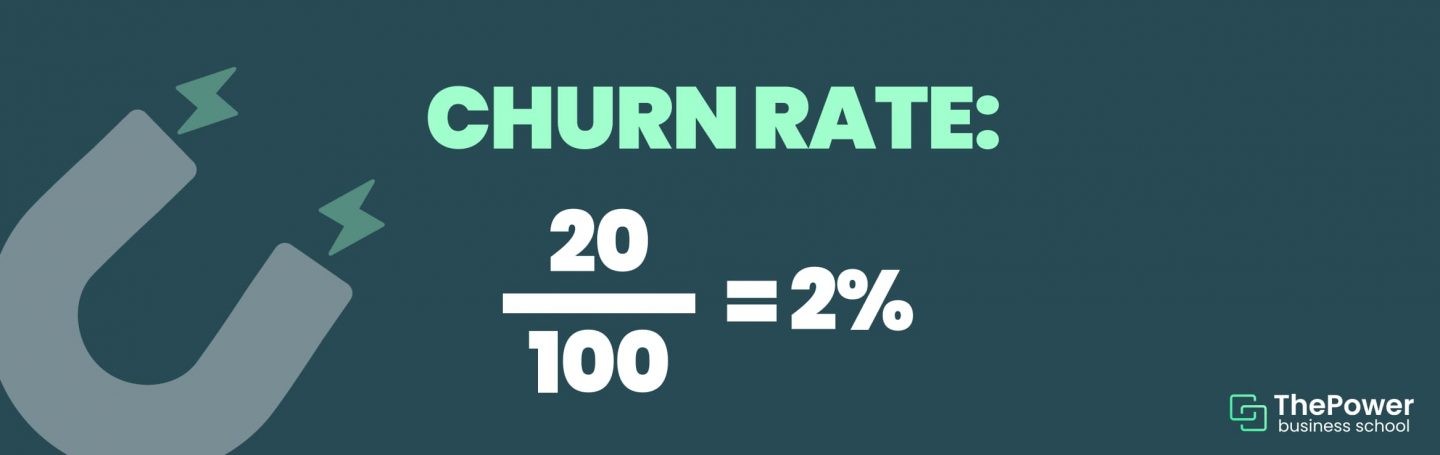

To put it simply, the Churn Rate is the percentage of customers who unsubscribe from our subscription within a given period of time. It is calculated by dividing the number of customers lost in a given period of time by the total number of customers at the beginning of that period.

Let's look at an example. Let's imagine that we have an E-learning company where every month customers pay a subscription to be able to access different online courses.

We started the business with 100 subscribers. In the second month we added 30 new subscribers, but 20 left. In this case to calculate the Churn Rate we should divide 20 (the number of people who unsubscribed from the service) by 100 (the number of people we started the business with). Our Churn Rate in this case would be of 2%.

Why is Churn Rate so important in a subscription business?

Now that we understand what Churn Rate is all about, we must tell you that if you have a subscription business, you always have to pay attention to this number and generate actions to improve it.

Why? Because in order to create a sustained business over time, the number of customers that we add month by month needs to be higher than the number of customers that leave, and we will know this by analyzing the Churn Rate.

It is useless to carry out complex and expensive acquisition marketing strategies if a few months after we add a new customer, he or she ends up leaving. Our attention must always be focused on thinking of strategies that allow us to keep customers with us for as long as possible. That is to say, that the CLTV is high.

And what is this CLTV? A new metric that is closely related to what we have been talking about and that we will explain below.

What is CLTV and how does Churn Rate relate to it?

As its acronym indicates, Customer Lifetime Value is a forecast about the amount of money your business expects to receive by analyzing the average amount of time a customer consumes your services or products.

However, to calculate it we will have to take into account some variations depending on the business model. It is not the same to calculate the CLTV for an e-commerce business than for a subscription business.

And it is in subscription business models where Churn Rate and CLTV are related.

To calculate the CLTV in a subscription business, the formula is very simple. We must multiply the value of the fee (ARPU) by the average amount of time a customer is with us (LIFETIME) by the gross margin of our business.

If we go back to the example of our E-learning business it would look something like this:

Let's imagine that the fee is 30 usd, our customers stay in the business about 3 years on average (36 months) and our gross margin is 35 %, the CLTV of our customer is 45,360 usd. This means that, on average, this is the amount of money we will receive from each of our customers.

And this is where Churn Rate becomes especially important for subscription businesses, because this metric is the one that tells us how many customers we are losing month by month and this affects the CLTV directly.

Subscription businesses are cost-effective as long as they can keep the CLTV high and the Churn Rate low, and that should be your main goal.

Now that you have all this information, all that's left is to sit down and analyze the numbers of your business to understand how it's doing. We are sure that when you start analyzing these numbers you will get some revealing information.

Can you think of any other advantages of subscription businesses? We'll read you in the comments!

Looking for something specific?